intraday trading ka best & profitable strategy

Upstox Stock Trading, Demat, Brokerage and Reviews 2022

99.03% 4,261,522 Clients

Upstox Account Orifice Enquiry

FREE Account Porta + Rs 1000 brokerage credit + Rs 0 Demat AMC + Pay flat Rs 20 per trade for delivery, Intra-day and Fdanamp;O. Open Instant Accounting and start trading today.

Upstox is a tech-first reduced monetary value broking firm in India providing trading opportunities at unbeatable prices. Company offer trading on different segments such equally equities, commodities, currency, futures, options which are available on its Upstox In favor Web and Upstox Pro Roving trading platforms.

Upstox is backed aside a group of investors including Kalaari Capital, Ratan Tata and GVK Davix.

Upstox trading platform offers trading, depth psychology, charting and many more rich trading features. This platform makes it slowly to place orders through mobile phones and browser. Upstox trading chopine is collective on Omnisys Draw close OMS (Consecrate Management System) and Omnisys NEST RMS (Endangerment Management System).

Trading in Equity Fdanadenosine monophosphate;O, Equity Indra-day, Commodities and Currentness Derivatives is available through Upstox Pro. Upstox In favor of is the paid serve of Upstox for traders.

Exclusive offer aside Upstox

- Freed Account Opening.

- Get Rs 1000 brokerage credit.

- Rs 0 Demat AMC.

- Pay flat Rs 20 for Combining weight Legal transfer, Intra-day and Fdanamp;O Trades.

- Give Rs 0 mission for Reciprocative Funds.

It is a qualified-time offer. Open Instant Account and start trading the cookie-cutter day.

Upstox Charges 2022

- Upstox Account Opening Charges: Rs 249

- Upstox Demat AMC: Rs 0 (On the loose)

Upstox Equity Delivery danamp; Intraday Charges

Upstox equity delivery brokerage house is Rs 20 or 0.1% whichever is lower per order. Upstox fairness intraday brokerage firm is Rs 20 per executed order or 0.05% (whichever is lower).

| Upstox Charges | Fairness Deliverance | Fairness Intraday |

|---|---|---|

| Brokerage | Rs 20 per dead order or 2.5% (whichever is lower) | Rs 20 per executed lodg or 0.05% (whichever is lower) |

| STT | 0.1% along both Buy and Sell | 0.025% along the Sell Side |

| Transaction Charges | Rs 325/crore | Rs 325/crore |

| Demat Transaction Charges | Rs 18.5 per scrip (only happening sell) | Rs 0 |

| GST | 18% (on Securities firm + Transaction Charges) | 18% (happening Brokerage house + Transaction Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Duty | 0.015% (Rs 1500 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-side |

Upstox Equity Fdanadenylic acid;O Charges

Upstox Fairness Fdanamp;O brokerage is Rs 20 per dead order or 0.05% (whichever is lower).

| Upstox Charges | Equity Futures | Equity Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| STT | 0.1% (on Sell Side) | 0.1% (on Deal Side) |

| Dealings Charges | Rs 210/crore | Rs 5500/crore happening premium turnover |

| Demat Transaction Charges | Rs 0 | Rs 0 |

| GST | 18% (connected Brokerage + Transaction Charges) | 18% (on Brokerage + Dealings Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Duty | 0.002% (Rs 200 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-go with |

Upstox Currency Charges

Upstox Currency brokerage is Rs 20 per executed order or 0.05% (whichever is lower berth).

| Upstox Charges | Currency Futures | Vogue Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per dead order. |

| STT | No STT | No STT |

| Transaction Charges | NSE: 0.00013% | BSE: 0.00062% | NSE: 0.065% | BSE: 0.026% (on premium) |

| GST | 18% (on Brokerage firm + Transaction Charges) | 18% (on Brokerage house + Transaction Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Seal Duty | 0.0001% (Rs 10 per crore) on purchase-side | 0.0001% (Rs 10 per crore) on buy in-side |

Upstox Commodity Charges

Upstox Commodity brokerage is Rs 20 per executed order or 0.05% (whichever is let down).

| Upstox Charges | Commodity Futures | Commodity Options |

|---|---|---|

| Brokerage | Rs 20 per dead order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| STT | 0.01% connected sell trade (Not-Agri) | 0.05% on sell trade |

| Transaction Charges | 0.0031% | 0.002% |

| GST | 18% (along Brokerage + Dealing Charges) | 18% (happening Brokerage + Transaction Charges) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Tariff | 0.002% (Rs 200 per crore) happening buy-side | 0.003% (Rs 300 per crore) on buy-side |

Upstox Charge Explained:

- STT: This is charged only on the sell side for intraday and FdanAMP;O trades. It is charged on some sides for Delivery trades in Equity.

- Stamp tax: Charges based on the state the customer is located in.

- Goods and Services Tax (GST): This is charged at 18% of the number cost of brokerage plus transaction charges.

- SEBI Turnover Fees: This is charged at Rs 10 per Crore.

Early Charges (Upstox Broker Hidden Charges / Fees):

- Call option danamp; Trade: Rs 20 per executed order

- Physical condense notes: Rs 25 per contract note plus courier charges. (Digital contract notes are free.)

- Instant Money Transfer Fee: Rs 7 per transfer

Visit Upstox Brokerage Charges Revaluation for to a greater extent detail.

Special Offer: FREE Calculate Porta + Rs 1000 brokerage credit + Rs 0 Demat AMC + Pay flat Rs 20 per deal out for delivery, Intra-day and Fdanamp;O. Open Instant Account and start trading today.

Upstox Online Account Porta

- To unresolved an account with Upstox; please leave your information and Upstox example volition contact you.

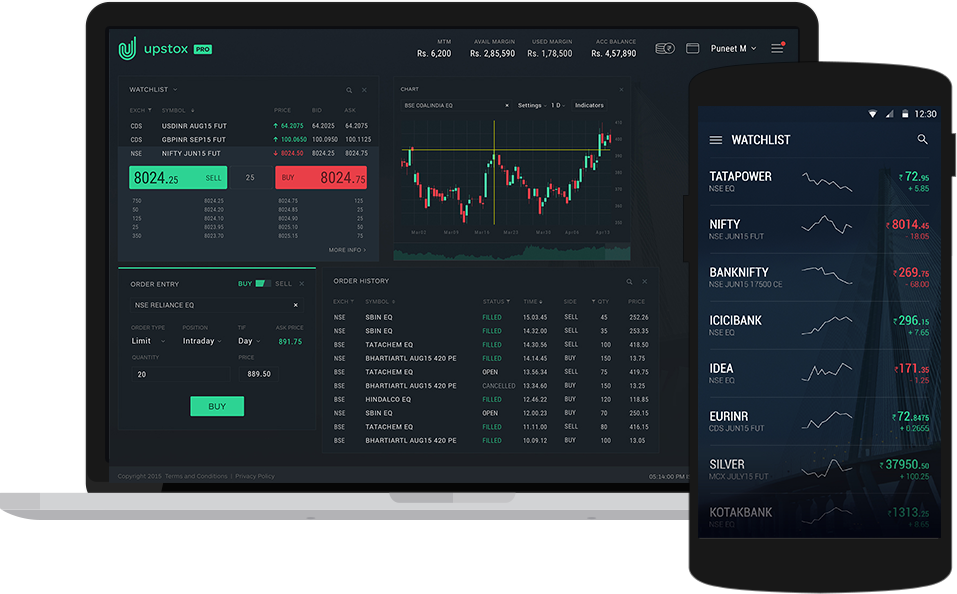

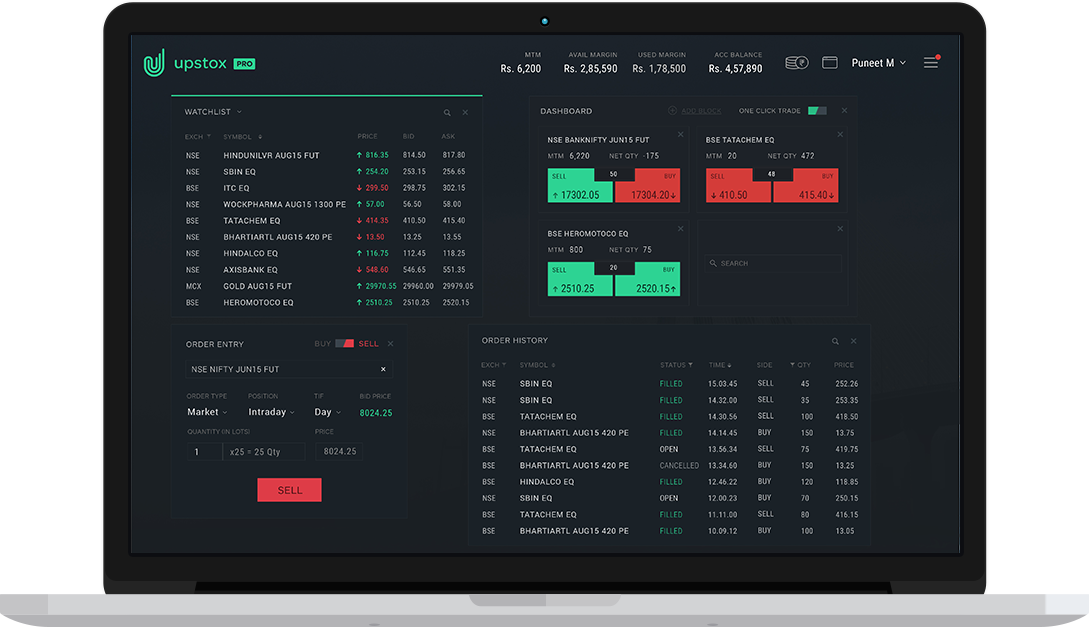

Upstox Trading Software (Upstox Trading Platforms)

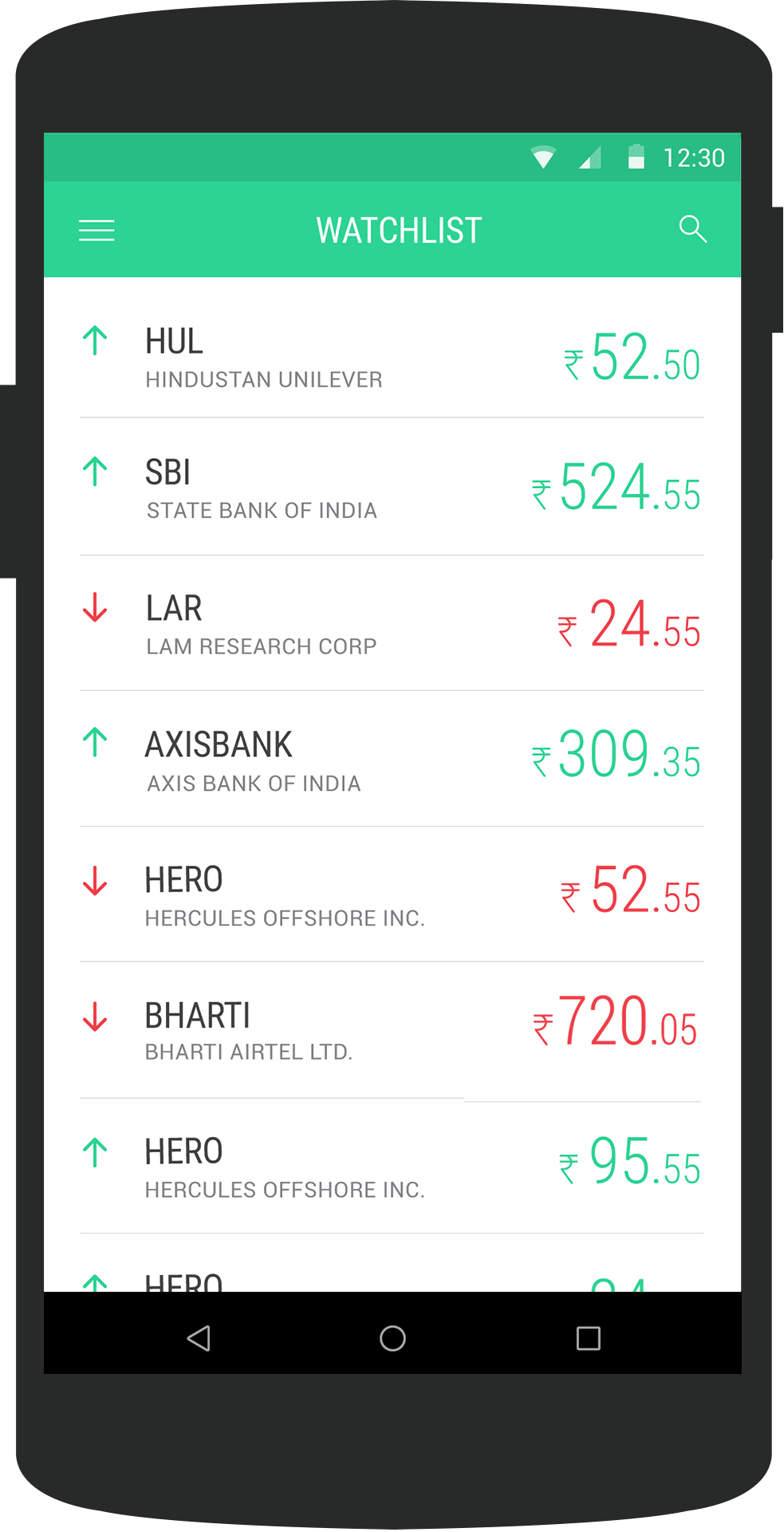

Upstox offers transplantable and website based trading. Upstox's trading platform is build in-house by RKSV to cause information technology passing easy to place orders through ambulatory as well as web browser. As of at once no trading terminal is available though Upstox.

Upstox Website danamp; Waterborne

Upstox Website

Upstox Mobile

Upstox Mobile

Gossip Upstox Trading Software Review for more detail.

Upstox Pros and Cons

Upstox Pros (Advantages)

The following are the advantages of Upstox. You must read Upstox advantages and disadvantages before curtain raising an account with Upstox. Upstox pros and cons help you uncovering if it suits your investment needs.

- Rs 0 Demat account maintenance charges.

- Flat Rs 20 per trade brokerage across all segment including rescue, intraday and Fdanamp;O at BSE, NSE and MCX.

- Mobile trading app getable for both Android and iOS phones. No software uses charges.

- After Commercialize Order (AMO) and Cover Order are available on some web and mobile.

- Tracking-Stop/Stop-Loss (SL) is available in both web and mobile.

- Upstox Favoring Web Trading Weapons platform offers multiple indicators to monitor markets along-the-run along.

- Upstox Bridge for AmiBroker helps you to code danamp; execute your trading strategy using the AmiBroker AFL editor.

- Upstox Developer Console helps you build (cipher) your possess trading app victimization languages such A Python.

- Upstox Option Chain Tool helps traders find out Spot, Forthcoming prices, vertical comparison of rates, get inside information much as circuit levels, Open High Low Close and market astuteness. Information technology allows customers to measure volatility, open Interest, performance indicator and chink greeks as cured.

- Upstox MF Platform offers 1000's of Mutual Funds to invest in. Customers can opt Lumpsum or SIP pattern of investment.

- Margin Against Shares is available.

- Online Initial offering Application (UPI) is available.

Upstox Cons (Disadvantages)

The following are the cons of Upstox. Check the leaning of Upstox drawbacks.

- Equity delivery brokerage is Rs 20 per trade. Most other brokers offer brokerage free investment in securities market.

- Intellectual Till Cancelled (GTC) and Good Till Date/Time (GTD) Orders are non purchasable in Fairness Segment. GTC/GTD orders are available in commodity trading.

- Gross profit Support is not open happening delivery trades.

- Upstox doesn't offer up unlimited monthly trading plans.

- Call and trade tip is charged at extra Rs 20 per executed put (Rs 20 Brokerage + Rs 20 Call danamp; Trade wind Bung).

- Additional Rs 20 per dead order is charged for Intraday direct MIS/BO/CO orders when they are not substantial off by the customer.

- Doesn't provide stock tips or recommendations.

- 3-in-1 accounts are non available Eastern Samoa company doesn't bring home the bacon banking services.

- 24/7 customer service is not available.

- Upstox NRI Trading and demat invoice is no more gettable (since Jan 2022).

- Upstox doesn't declare oneself API accession for machine-controlled trading.

Upstox Margin Pic

Upstox margin for intraday trading is up to 20% of craft prise (max 5x purchase) based on the origin. Upstox Fdanamp;O intraday trading gross profit is 1.3x across Equity, Currency, and Commodity trading at BSE, NSE, and MCX. There is no additional margin offered for Upstox Fdanamp;O carry forward-moving positions and fairness delivery trades.

| Segment | Security deposit | Leverage |

|---|---|---|

| Equity Delivery | 100% of trade value | 1x |

| Equity Intraday | Up to 20% of trade value | 5x |

| FdanAMP;O (Equity, Up-to-dateness and Commodities) | 100% of NRML margin (Span + Vulnerability) | 1x |

Upstox Ratings

Based on 124 Votes by Upstox Customers

Do you trade with Upstox? Rate Upstox

Upstox Ill

The number of Upstox customer complaint received by the exchanges. The Upstox consumer ailment written report helps savvy the Upstox quality and relibility of service.

| Exchange | Fiscal year | Number of Clients* | Complaints** | % |

|---|---|---|---|---|

| NSE | 2021-22 | 4,261,522 | 352 | 0.01% |

| BSE | 2021-22 | 499,893 | 32 | 0.01% |

| NSE | 2020-21 | 2,141,095 | 862 | 0.04% |

| BSE | 2020-21 | 143,126 | 7 | 0% |

| NSE | 2019-20 | 619,305 | 164 | 0.03% |

| BSE | 2019-20 | 142,797 | 11 | 0.01% |

| NSE | 2018-19 | 92,781 | 58 | 0.06% |

| BSE | 2018-19 | 22,381 | 7 | 0.03% |

| NSE | 2017-18 | 43,889 | 35 | 0.08% |

| BSE | 2017-18 | 24,483 | 2 | 0.01% |

* The number of active customers reported past the agent.

** The total figure of complaints received against the agent at the given exchange.

Visit Upstox Complaints at BSE, NSE and MCX for detail report.

Frequently Asked Questions

-

1. What is Upstox explanation?

Upstox account is a 2-in-1 account combining a trading and a demat account. The trading account gives you entree to well-worn exchanges comparable NSE, Bovine spongiform encephalitis and MCX etc, spell the demat account is accustomed obtain securities like stocks, mutual funds etc., in electronic form.

The upstox account allows investors to invest/craft in stocks, equity derivatives, currency and commodities. IT too offers online mutual fund (regular and direct) in a lubber sum or SIP way.

-

2. How to available Upstox account online?

Upstox offers instant paperless online account statement opening to masses who sustain an Aadhaar Card linked to their current phone enumerate.

Stairs to unfastened Upstox news report online

- Chat www.upstox.com website.

- Enter E-mail and Nomadic Turn

- Formalise with OTP

- Move in own and bank details

- Upload Aadhaar Card, Tear apart Card, Income Proof (for derivatives trading), Signature (on a empty composition) and photograph.

- Review, confirm and submit the lotion.

You can expect your account to exist activated within the next 24 - 48 hours. The company volition inform you direct email and SMS.

-

3. Upstox is good or bad?

Upstox is an online discount broker offering trading services in stocks and commodities. It is one of the 200+ large stock broker oblation retail trading services, who are in the business for 10 to 25 years.

No broker is obedient or bad. Information technology depends if a broker suites your requirement for trading and investment.

Read upstox brush up and compare information technology with top brokers to find which broker best suits you:

- Upstox Vs Zerodha

- Upstox Vs ICICI Direct

- Upstox Vs Sharekhan

Here are a a few pros and cons of Upstox which Crataegus oxycantha help you determine if upstox is salubrious.

Upstox Advantages and Disadvantages

Upstox Advantages Upstox Disadvantages - Ultra-low broker (Rs 20 per trade) for Bringing, Intraday and FdanA;O

- Commission-freeborn Direct Mutual Cash in hand

- Excellent online trading platform (Website and Mobile App)

- Bracket and Cover Orders available

- Margin against share is disposable

- Doesn't pass Brokerage-Free Equity Delivery trading.

- No neck of the woods offices in your township. It's an online broker.

- No personal relation manager

- No enquiry and advisory services

- No GTC Orders

- Doesn't offer NRI trading account

- Margin funding not available

- Extra Rs 20 for Hollo danadenylic acid; Trade orders

- Additional Rs 20 for the auto square of intraday orders

- It doesn't offer time unit unlimited trading plans.

- IT doesn't offer API to alog traders.

-

4. Who owns Upstox?

Upstox is a private small-scale party owned away Mumbai based RKSV Securities Pvt Ltd. Mr. Ravi Kumar, Mr. Raghu Kumar and Mr. Shrini Viswanath are the co-founders of the company.

The company is also backed by a group of investors including Rattan Tata, Tiger Global and GVK Davix.

Upstox investor includes:

- Tiger Global Management - 31.1% stake

- Kalaari Capital Partners - 15.21% post

- GVK Davix Technologies - 2.54% gage.

- Ratan Tata - 1.33% stake

Remaining 50% scads are with the promoters of the company which includes Mr. Ravi Kumar and Mr. Shrinivas Viswanath.

The above shareholding is as of Jan 2022.

-

5. Is Upstox free?

Upstox is not free. IT charges securities firm bung at fixed Rs 20 per executed order crossways every segments and exchanges. In addition, customers have to pay government taxes, exchange dollar volume charges, demat debit transaction fees etc.

Take note: Other discount brokers like Zerodha offers brokerage-free equity delivery trades. This means the client doesn't have to pay whatever brokerage when they buy and deal out shares in a demat account.

Upstox Brokerage Fee

Segment

Brokerage Charges

Delivery

Rs 20 per trade operating theatre 0.1% (whichever is turn down)

Intraday and Fdanadenosine monophosphate;O

Rs 20 per barter surgery 0.05% (whichever is lower)

-

6. Is Upstox trusty?

Yes, Upstox is a trusted lineage broker. Here are a hardly a facts which make upstox trustworthy:

- In the business for terminated 10 years.

- Lakhs of retail customer trading online with upstox daily

- SEBI registered broker.

- Member of BSE, NSE and MCX exchanges.

- No major violations reportable in the audits aside the exchanges so furthest.

- Backed by prominent investors like Mr. Ratan Tata.

- Profit making company with zero debt.

-

7. How to patronise Upstox?

To buy shares, ETFs and mutual funds, you need to first open an account with upstox. Upstox opens 2 accounts, a trading and a demat account. The trading account is for buy in/sell Oregon securities and a demat account is to clutch your securities in electronic format.

One time your accounts are opened, you can then issue the next steps to buy at Upstox:

- Run along to World Wide Web.upstox.com operating theater download Upstox Mobile App.

- Login using user ID and password

- Explore for the desirable security away entering a few characters of its name, say REL for Reliance

- Enter the quantity, select order character, position etc.

- Review your order and Confirm

To watch a loaded demonstration of placing a buy consecrate on the Upstox Professional web, you can watch this present video.

-

8. How to buy IPO Upstox?

Upstox offers an online IPO application. Upstox customers can apply in any IPO at BSE and NSE using their UPI ID.

Steps to apply IPO through Upstox

- Login to Upstox In favor of Web or Upstox mobile app

- Click on your customer name and client ID on top right

- Get through on Enforce for IPO link

- Select the IPO you care to apply past clicking the 'Inside information' button

- Attend the bottom on IPO Detail page and click 'Place Bid' clitoris

- Enter upon UPI ID and opt Investor Type

- Enter order measure and price

- Opt Cutoff-toll checkbox if applying in the retail family

- Reexamine and place lodg

- Approve the notification received on the BHIM app in 2 to 12 hours.

If you have a upstox demat account, you prat also apply in IPO using an online IPO readiness offered by your bank victimisation net banking. Nearly all popular Sir Joseph Banks including ICICI, HDFC, SBI, Kotak, Axis Camber offer online IPO.

You just have to mention your upstox demat history information in the IPO application form. The allocated shares are mechanically delivered to your upstox demat account. You can sell them on the IPO itemization day.

-

9. How to transfer money from Upstox to the bank account?

To transferral money from your Upstox trading account to the bank answer for, you need to submit a 'Payout' request in the Upstox Pro Trading Web site or Upstox Favoring Mobile App.

Steps for Fund Withdrawal using Upstox Website

- Visit www.upstox.com

- Vibrate over linkup 'Check in' in the top navigation and click 'Pro Web'

- Log in to the trading internet site

- Click the 'Balance' link in the top of the inning right.

- In the popup window, click the 'Take away FUNDS' button.

- Enter the amount and click 'WITHDRAW' button

Steps for Investment trust Withdrawal using Upstox In favor of Mobile App

- Login to the Upstox Pro Mobile App.

- Click on the 'Funds' clitoris in the bottom right

- Click on 'Withdraw Funds' link

- Enter the amount and dog 'Crawfish Funds' button

-

10. How to earn from Upstox?

Upstox runs a Partner Program wherein you can get along a sub-broker and start referring customers from your network and outside, and earn commissions when they trade. You bathroom earn 2 ways in this program:

- Earn a part of the brokerage paid by your referrals

- Earn incentives for referrals when they open a Upstox account

Note:

- Any individual or company can become a upstox partner.

- No need for physical berth or infrastructure.

- Website, YouTube channel, Blog, etc. owners can also go a partner.

- Only brokerage earnings are mutual. Earnings from other sources i.e. Demat AMC, Demat Charges, Dealing Charges, Interest earning, computer software charges, etc. are not shared with a partner.

- Partners stupefy absolute exemption. No targets and no sells-pressure.

- Fantabulous online married person portal to track your earnings and manage your clients.

-

11. How to snuggled Upstox account?

Upstox invoice toilet be closed online through the Upstox mobile app or the web portal by submitting an Account Closure request. It takes7 daysdannbsp;for Upstox to close your account post the answer for closure request is submitted.

Steps to close Upstox account

- Login to the Upstox app or website.

- Chatter connected the Name at the top left corner.

- Go to the Account tab key.

- Chatter on Visibility.

- Click on Catch All option placed next to Account.

- Click on the leash lines on the crest left turning point.

- Click on Account Closure low the Account department that lands you on the Account closure page.

- Click on "Close account".

- Snap on the link that will take you to the "Account Closure Request page".

- Choose thereason for closing your account.

- Click on "Ending account".

Before submitting the Upstox Write u Closure request

- Perspicuous all great dues.

- Close all open Fdanamp;O trade positions.

- Sell Beaver State transportation holdings from your Demat account.

- Pay off any Mutual Funds in your account.

- Clear slay any Digi Gold balance from your explanation.

Note:

- The account resolution data link generated is sent connected the documented mobile number and netmail id and is valid for 30 days.

- If you are using the stale version of the Upstox mobile app, you will find the invoice closure option nether the My Account section in your Profile.

-

12. Does Upstox allow BTST?

No, Upstox doesn't allow BTST (Buy Nowadays Sell Tomorrow) facility.

They stopped offering BTST from 1st September 2022 after SEBI introduces the new border insurance.

If you buy 1000 shares of TCS on 1st Sept 2022, you would be competent to sell these shares only after these shares are credited in your demat account on T+2 days. It means you cannot sell these shares before 4th September 2022.

-

13. How to thick Upstox 3 in 1 account?

Upstox 3 in 1 account (IndusStox business relationship) backside make up closed online using the Upstox Mobile Trading app or trading website. The account stoppage request process is simple and takes a few minutes. It takes 7 days for upstox to close the request once the call for is received.

Steps to close 3 in 1 Upstox account statement/ IndusStox account:

- Login to your Upstox network or mobile accounting.

- Look for for the "Account closure" section under your Profile dangt;dangt; Account.

- Click on "Close account".

- Click happening the linkdannbsp;to confirm account closure.

- Choose the rationality for closure on the account closure form.

- Dog on the "Close account" button.

Earlier submitting an account closure request, ensure to:

- Crystalline any pending dues.

- Channel/Deal off the holdings.

- Settle ajar positions, if some.

Note:

If you close your 3 in 1 IndusStox inside 14 years, thither are no charges.dannbsp;However, if the account is blinking after 14 days and within six months, you get supercharged with Rs 200, Oregon the account balance, whichever is lesser.

214 Comments

Are you a Zerodha Customer?

By Popular Descent Brokers

Loose Account Opening

Rs 1000 brokerage credit

Rs 0 Demat AMC

Flat ₹20 Per Trade

Enquire Now

intraday trading ka best & profitable strategy

Source: https://www.chittorgarh.com/stockbroker/upstox/33/

Posted by: buidelps1967.blogspot.com

0 Response to "intraday trading ka best & profitable strategy"

Post a Comment