Forex For Beginners: What You Need To Know To Get Started...and Everything In Between!

Did you know Bitcoin is the top 5 about actively traded asset?

But if y'all are new to the cryptocurrency market and wondering what cryptocurrency trading is all about, and so you've come up to the correct place.

Of course, this question might not exist that piece of cake to answer. That'due south why we're explaining the concept in a more digestible way.

And this is definitely Not your typical blog.

Ultimately, y'all'll be able to make up one's mind for yourself if crypto trading is something for y'all.

Chapter 5

Trading Terms

Affiliate seven

Gamble Management

BONUS Chapter

Recap

Chapter 1

UNDERSTANDING THE CONCEPT OF CRYPTO TRADING

Run a risk comes from not knowing what you're doing — Warren Buffett.

That is precisely why we're helping you to set a good foundation.

And in this affiliate, we're going to bear witness you where and how to start trading crypto.

So whenever the chance is here, you're prepare to seize the opportunity to grow your funds.

Let's dive in!

What Is Cryptocurrency Trading?

Cryptocurrency trading is an exchange of digital currency betwixt traders. It allows them to profit from price fluctuations acquired by need and supply. Trading cryptocurrency is too risky and rewarding at the same time due to its volatile nature. However, hazard tin can be mitigated by hedging or diversification.

Cryptocurrencies may be in the babe phase. Yet, the recent BTC toll soared have been catching a lot of fizz in the news. Beyond Bitcoin, there are thousands of digital assets, including altcoins, to trade on dissimilar trading platforms. Typically, a trader would purchase a digital asset and sell it at a higher price in just minutes or weeks, depending on his trading styles.

How Does The Crypto Trading Market place Work?

The cryptocurrency market, equally most financial markets, is driven by supply and demand. When demand is college than supply, the cost of the nugget moves higher. When the supply is larger than the demand, the toll of the cryptocurrency tends to fall.

But is information technology that easy?

If it were so easy, we would all be millionaires. Notwithstanding, at that place are unlike means to analyze the crypto marketplace and recognize different trends.

When a cryptocurrency moves higher for longer periods, so it is called a bullish tendency. While a surly market happens when the market falls for a longer time. Still, nosotros tin make some profitable trades during both balderdash and bear markets if you apply the right strategy.

Trends are divided into impulse waves and corrections. In a balderdash market place, the impulses are up, and there are also dips – price corrections that are not large enough to get-go a bear market. In deport markets, the impulse waves are down, and the corrections are price spikes that are non potent enough to create a bullish trend.

Therefore, traders aim for the impulses or the overall tendency film rather than for the correction. That is considering tendency impulses provide a more significant price alter for a shorter time.

How Is Crypto Different From Stocks and Forex?

The master difference between cryptocurrency trading and stocks or forex trading is the underlying nugget in respect to generate income. In the stock market place, investors merchandise stocks.

Some of these stocks include the following:

- Apple tree (AAPL)

- Tesla (TSLA)

- Amazon (AMZN)

- Alphabet (GOOGL)

The forex marketplace is unlike as investors can handle a wide range of currencies. For instance, they can trade USD confronting the JPY or GBP against the EUR. The most popular trading pairs in the forex market include EUR/USD, GBP/EUR, USD/JPY, and others.

And then where practice cryptocurrencies fit in?

People trade cryptocurrencies through a wide range of trading platforms. These platforms are known as cryptocurrency exchanges. From there, you can select the types of products from spot trading, margin trading, derivatives trading, and more than. Ultimately, you earn from the toll fluctuation and speculation.

When comparing the stocks and forex market with cryptocurrencies, the market place is much more than volatile. In fact, information technology is possible to see cost fluctuations of 100% that tin accept place in just hours in the crypto market place. Whereas stocks trading is rather quite conservative.

The stock and the forex marketplace are very liquid, and they're considered the largest and most liquid in the market. That's considering it handles some of the world'due south largest trading, which prevents them from accounting for huge fluctuations.

Of course, cryptocurrency trading volumes are growing exponentially. Notwithstanding, a major transaction or news event can trigger a pregnant impact on the crypto toll.

One significant divergence is cryptocurrency trading stays active 24 hours a twenty-four hour period, seven days a week, dissimilar stocks or forex, which only operates at a designated fourth dimension-frame.

Types of Cryptocurrency

There are dissimilar types of cryptocurrencies. Typically information technology's either Bitcoin (BTC) or Altcoins (alternative coins). Of course, there are however a variety of tokens like the ERC20 tokens, utility tokens, stablecoins, and more.

In many instances, Bitcoin is the primary driver for the crypto market place. Hence, if BTC is on the bull, almost altcoins would follow the trend. Some of the famous altcoins include Ethereum (ETH), Chainlink (LINK), Litecoin (LTC), Ripple (XRP), Polkadot (DOT), Cardano (ADA), and more.

Bitcoin works every bit a store of value and as a decentralized network to transfer funds. Ethereum is a smart contract blockchain that is powered past Ether (ETH). XRP, instead, is a digital nugget used by RippleNet companies and users that ship cross-border payments.

There are thousands of virtual currencies (nosotros volition go into details in the side by side section). Each day new cryptocurrencies are being created and released to the market place.

How Many Cryptocurrencies Are In that location?

At this stage, yous're aware at that place are many altcoins.

Wait, how many cryptos are at that place exactly?

According to data provided by Statista, there are around 4,000 digital assets in circulation. This is certainly a lot if we compared it with the market size a few years agone.

Dorsum in 2017 and 2018, at that place was an Initial Coin Offering (ICO) blast. At that time, different projects and companies were releasing their own tokens. These tokens were sold to users for BTC, LTC, ETH, and other digital assets.

Notwithstanding, nigh of the ICO tokens are obsolete. Just a few of them were able to sustain the fall and even soared in price. Some of these tokens include Ethereum and NEO.

Information technology is worth considering that other digital avails are bachelor for users only are often not reported on CoinMarketCap or Coingecko. Withal, the number is expected to continue growing in the next few years looking at the exponential interest from beginners to institutional investors.

CHAPTER 2

ARE YOU A TRADER OR INVESTOR

One of the most frequently asked questions, "Is trading better than investing?"

While both methods assist you profit in the financial or crypto market, merely in that location is indeed a difference.

And then, let's run across how they are different from one another.

Find out if you're in for short-term profits or instead for long-term gains.

Trading Crypto vs. Investing in Crypto

Cryptocurrency trading refers to traders who often take advantage of small mispricings in the market past entering and exiting a position over a short timeframe. It involves conducting deals on margin without actually owning the nugget, speculating on the price moves.

In nigh cases, trading refers to opening and endmost positions oft based on the different market conditions.

While investors seek larger returns over an extended period through buying and holding. Information technology too ways an investor would buy and own a digital asset with the belief that its cost will increase. Then, sell it for a substantial amount of profit.

The Types of Crypto Traders

The cryptocurrency market, besides as other traditional markets, has short- and long-term traders. Some of them are searching for short-term profits, while others are trying to build a portfolio for several years.

LONG TERMS

HODLERS (Hold on for Dearest Life)

Hodlers are the most popular strategy for beginners who tend to invest in cryptocurrencies for the long term. Mainly because information technology's the virtually straightforward strategy and it requires minimal supervision to manage a position.

Withal, you maybe asking how long I should invest?

Typically, there is no dominion regarding how long a hodler should hold onto its digital avails. Instead, a hodler would buy and hold their digital avails for long periods without an exact selling price.

That's exactly how the famous sentence, "Stay strong, HODL even when the price drops" derived.

Regardless of the bull or bear market, a hodler would continue to invest instead of endmost their positions. Financially, this could be a harmful strategy if the trader does not take profits when opportunities are presented. However, there may be complications to every conclusion made.

Meanwhile, those users who can hodl and sell at the right time (when the cost was much college than when they purchased their digital assets) would make profits.

Position Traders

Position traders buy an nugget and hold it for long periods until the marketplace reaches the cost level they were waiting for. The positive point is this trading strategy does non crave traders to be actively involved in trading. The key is to invest from a holistic betoken of view past assessing the trends.

Y'all can simply buy an nugget and concord until they consider it is time to sell (unremarkably when the cost moves higher). The main difference between position traders and hodlers is related to the attachment that position traders accept with their avails. A position trader is not attached to the asset as a hodler might be.

Consequently, it is much easier for a position trader to sell his funds as shortly as the opportunity is present in the market.

Short-TERMS

Every bit there are long-term traders, we tin can too place short-term traders. Cryptocurrency trading is platonic for brusk-term investors to make large profits. That'south because the volatile crypto marketplace is in favor of curt-term trade. But there are different strategies for short-term traders, which tin exist day trading, swing trading, and scalp trading.

Solar day Traders

Twenty-four hours traders open and close their trades within the day. A solar day trader would take his position open for only a few hours. In some cases, only a few minutes. These traders need to be very disciplined. They must have an exact selling point to realize their profits. A small-scale tick of 0.1% is sometimes enough on their positions to make a few hundreds of dollars per twenty-four hours.

Additionally, day traders work with very tight stop loss. That allows them to reduce their risk and be set up to open a new position if the market does not move in their expected management.

Swing Traders

Swing traders are different from 24-hour interval traders. The chief divergence is related to the time they can wait for an open position.

Swing traders are the ones who keep their trades from more than one 24-hour interval to sometimes a month. The goal is to understand where the market place is going in the next few days and aim for that move. Commonly, these traders wait for larger profits. Let's say that a trade that is open for 3 days and registering a 2%profit could be considered a successful swing merchandise.

Since swing traders aim for higher cost moves with their trades, they likewise tolerate higher take chances. A swing trader can mitigate a more pregnant price fluctuation confronting his trade, where the day trader will already be out of the market.

Scalp Traders (Scalping)

Scalp traders are mean solar day traders that open and close trades every single hour. These traders are searching for minimal toll fluctuations that would permit them to make small profits on their funds.

Dozens of positive scalp trades could help the scalper get as much money as a day trader. The goal is to catch as many positive trades as possible in a short fourth dimension. In many cases, scalp traders tin brand hundreds of transactions per day. Also, they would never go out a position open for the next mean solar day.

Understanding The Cryptocurrency Trading Environments

Spot Market

The spot market is the most popular trading market environment for cryptocurrencies. It allows traders to buy or sell an asset now at its electric current price (spot price).

But how does information technology piece of work exactly?

Supposed you desire to buy one BTC at present, then you go through the spot market. The merchandise executes as before long as your lodge gets filled. If you use, for example, a market order, the trade will become through as presently as y'all click on the buy or the sell button.

The spot market place allows you to merchandise the cryptocurrency you want in a more than realistic arroyo. That means you will be the owner of the cryptocurrency you are trading.

The cryptocurrency spot market operates 24 hours and provides liquidity to trades at whatsoever time of the day.

Derivatives Trading

Derivatives correspond an underlying nugget such every bit cryptocurrencies.

Through derivatives, traders can get access and exposure to different markets without necessarily belongings the underlying asset. Derivatives contracts can include cryptocurrencies, stocks, bolt, currencies, and even a basket of different assets.

Each of these categories has different characteristics and would provide traders with dissimilar trading solutions to speculate on the price or hedge confronting risks.

Frontwards and Futures Contract

Another popular cryptocurrency trading method involves futures trading and frontward contracts.

Futures contracts are traded on exchanges, where the price is settled daily at a time to come rate. Crypto futures are more than suitable for margin trading, where leverage takes place to maximize profit.

Forwards contracts lock in the two parties into a formal agreement at present to execute a trade in the hereafter at a preliminary agreed charge per unit. Forwards are a great solution to hedge exchange rate run a risk.

Margin Trading

Margin trading allows traders to infringe funds to open larger positions in the market place. In other words, yous can utilise capital that you don't own (leverage) to aim for higher profits. It is crucial to know that trading cryptocurrency on margin exposes y'all to college potential returns, but at the same time, y'all can business relationship for losses of the same size.

But what does this mean?

Hither is an example with leverage of i:125.

Say that your account size is $1,000. A margin of 125 volition requite you a buying power of $125,000.

That helps y'all to increment your profits in a winning merchandise. Merely if your position moves in the opposite direction, you tin can lose all your funds used as collateral.

In simpler words, margin trading gives you the power to open bigger trading positions with smaller capital. Typically, the larger the leverage, the higher the potential returns. However, it is crucial to maintain leverage proportional to your trading size, as bigger leverage can vaporize your whole bankroll in seconds.

When we trade with leverage, our profits would be calculated on the funds we take borrowed. Let's apply a clear example:

If we had $one,000 and opened a long position with x125 leverage, nosotros would have a buying power of $125,000. If the market goes up 1%, the profits are calculated on the $125,000 rather than $1,000. In this example, a one% increase would bring returns equal to $1,250.

BTC/USD moving from $55,000 to $55,550 is an instance of a 1% jump in price. And it happens for only 12 minutes.

That was but a raw example to get the picture effectually the leverage numbers. In reality, you will never put your entire account on a single merchandise because a unmarried tick against your position will liquidate your whole account. After all, y'all volition have no funds for collateral. Likewise, we demand to have into consideration that trading platforms have fees. Moreover, if y'all borrowed funds to trade with leverage, you would accept to return them and pay the interest charge per unit to the lender.

Note:

Remember, the less you lot borrow on margin, the lower the adventure. And the more you infringe, the higher chance y'all take equally margin maximizes your losses also. Thus, information technology is very important to use take a chance management techniques and utilize cease-loss orders to limit your potential loss.

Perpetual Contracts

As compared to the futures contracts we mentioned before, perpetual contracts do not have an expiry date. At the same time, perpetual contracts are usually traded at a cost very close to the underlying cryptocurrency spot price. When comparing perpetual with spot trading, perpetual contract trading is neat because y'all can both short and long trades flexibly, unlike spot trading.

Cryptocurrency trading experts use these contracts to trade with leverage.

Perpetual contract markets commonly have high liquidity. In many cases, the trading volume of perpetual contracts is larger than the spot market'due south trading volume. Therefore, perpetual agreements provide an excellent opportunity for traders to get exposure to college returns from digital avails.

Call and Put Options

Phone call and put options are derivatives in financial terms. They quote an underlying asset price, which tin can exist a stock, currency, article, or cryptocurrency. Options contracts are an agreement betwixt two parties that grants you the right but does not obligate you to buy or sell a financial asset at a specific price – the strike price.

There are 2 types of options contracts – a call choice and a put option.

CHAPTER 3

Key VS. TECHNICAL ANALYSIS

Primal analysis is great for long-term investment every bit data collection elapsing tends to exist longer as compared to technical assay.

Still, there are proven instances where traders made their millions using technical assay.

Still, wondering what truly defines central and technical assay?

Let's dig deeper!

Fundamental Analysis Fundamental analysis is an approach used by cryptocurrency investors to establish the intrinsic value of a crypto asset.... : Explained

The central assay references tools that can help u.s. empathize the valuation of cryptocurrencies and whether they are overvalued or undervalued. It's widely used by traders for long-term investment.Some of the tools that traders and investors utilize to do central assay include market capitalization, liquidity, volume, supply, and need.

Market Capitalization The market capitalization (or market place cap) of a cryptocurrency is a measurement of its market value. In other words, it...

Market capitalization in the stock marketplace refers to all the stocks of a company that have been released to the marketplace multiplied for their value. Whereas in the crypto context, the marketplace valuation can be obtained by multiplying the virtual currency toll for the supply of the asset.

Some digital assets have a modest supply of tokens merely a higher price. Other virtual currencies accept a larger coin supply and a lower toll per coin.

Liquidity and Trading Book

Liquidity is crucial for all financial avails and crypto, yet. The more than liquidity of an asset, the easier it trades on that nugget every bit the demand and supply are nowadays. Naturally, it means you can easily open up a position and exit the marketplace, likewise (if necessary).

Bottom-known cryptocurrencies (more often than not tokens released through ICOs) have picayune to no liquidity. Entering a large fund into a virtual currency with low liquidity is risky. It could but mean that the money could only be some other obsolete project accounted detrimental to your funds.

Instead, it would be a wiser choice to trade on assets with larger trading volumes. Commonly, the larger the trading volume represents better prospects.

Supply Machinery

Supply and demand is also an important thing to analyze when buying and selling virtual currencies. Many virtual currencies have a limited supply. For example, there is but going to be a total of 21 meg BTC in supply. That means when demands are loftier and supply is low. Ordinarily, need will so reflect in the price.

When traders and investors become bullish, BTC is withdrawn from exchanges. That creates a shock in the supply (fewer BTC bachelor). If need remains high, then the cost of the asset could move higher.

However, the contrary could happen.

If more than BTC coins are deposited to exchanges and demand falls, then the price could plunge.

Technical Analysis: Explained

Technical analysis requires analysts to understand a wide range of indicators and patterns in the charts. Rather than taking into consideration fundamental aspects of the digital assets traded, analysts focus on the charts.

Trend Lines

The most of import technical analysis tool in trading is the trend line. A trend line matches the tops or the bottoms of a cryptocurrency nautical chart to identify a surly or a bullish trend, respectively. If yous match more than than 2 increasing bottoms with the same line, this is a bullish trend line. It signals for a bullish marketplace.

If y'all match more two decreasing tops with the aforementioned line on the nautical chart, then this is a bearish trend line. Information technology indicates the presence of a bearish trend on the nautical chart.

This is an example of a bullish trend on the H4 chart of the BTC/USD.

Psychological Toll Levels

The psychological price levels are on-chart areas, where the toll is likely to show a turning bespeak on the chart. These can exist older levels, where we take already seen a reversal, or circular-number levels, which the mass of the market participants don't anticipate to see broken.

An case of a big psychological level was the $xx,000 at the BTC/USD. In 2018, the price clearly reached that level simply didn't manage to break it initially. The overall attitude was against this, which reflected the supply-demand market factor, causing a reversal. Now, this $20,000 level is long broken, and we are anticipating other significant psychological levels.

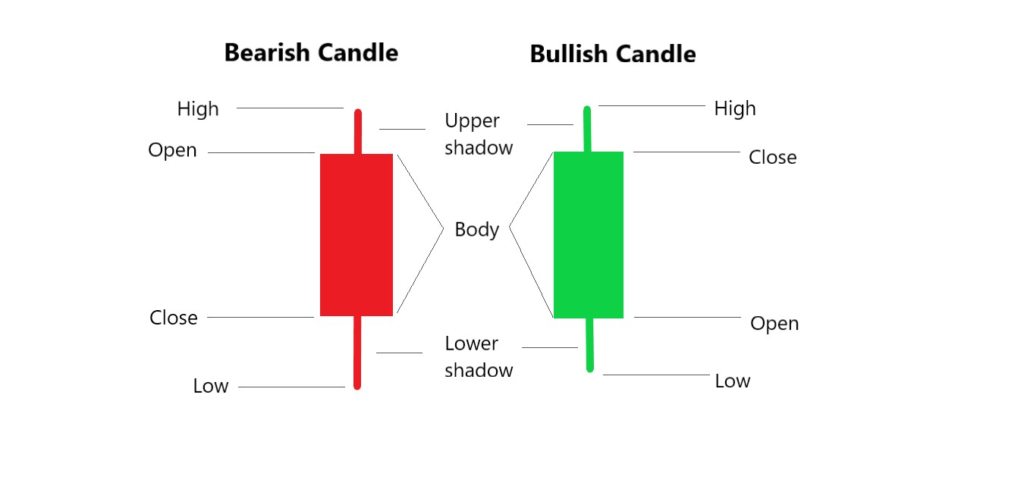

Candlestick Patterns

Candlestick patterns are on-chart Japanese candle formations that allow traders to discover specific price behavior. Although this does non provide certainties, information technology helps analysts understand how the market can behave if certain weather condition are made.

Some of the most popular candlestick patterns are Japanese candlesticks like Doji candlestick and Hammers, Engulfing, Evening and Morning Stars, and many more. Some of these patterns would evidence a change in the trend, while others would assistance to confirm a continuation.

Sample of a candlestick pattern:

Technical Indicators

Technical indicators are different from candlestick patterns. These indicators are additional tools added to the charts that allow traders to identify cost continuation or reversals.

Technical analysts focus on what they see on the charts rather than on fundamentals.

Some pop technical tools include Fibonacci levels, the RSI indicator, Moving Averages, the MACD indicator, or the pivot indicator. Traders do not necessarily have to follow just a straightforward indicator, but they tin can follow many of them to lucifer signals and act with a college certainty.

Are They Reliable?

Yes, technical and fundamental assay work in cryptocurrency trading. Nevertheless, different crypto coins tend to answer improve to different analysis approaches.

And then, Is Technical or Primal Assay Ameliorate?

In the cryptocurrency market, the technical analysis is more reliable for short-term trading. The interest in digital currency grows exponentially daily, which from a technical perspective creates unpredictable price spikes.

However, these spikes can sometimes be foreseen, because fundamental factors like Elon Musk and Grayscale heavily invested in Bitcoin could be a signal for that asset to grow.

CHAPTER 4

MARKET INTERPRETATION AND Assay

Past assessing the market quantitative and qualitatively, information technology helps you to understand the value of the market place, buying patterns, and of form, the overall economic environment.

In fact, many traders agree that keeping up with the market helps them make amend buying and selling decisions.

And then, what exactly is market analysis and interpretation? And what does information technology involves?

Reading The Price Chart

The bones and well-nigh of import technical assay technique is to read the toll chart of the financial nugget. Making your trading decisions based on price chart assay is called cost action trading.

Price action refers to using only on-chart tools, which do non involve actress calculations. These include analyzing the back up and resistance levels, trend lines, Fibonacci levels, chart patterns, candle patterns, trading volume, and more.

The Bulls and Bear Crypto Market place

Cryptocurrency trading experts are always searching for bulls and deport markets. A bull market refers to a positive trend in a specific trading pair. Whereas, a conduct market is a tendency that moves downwards.

Balderdash markets are typically good news. Fifty-fifty if the investor does non sell at the right moment, in that location is a high possibility they would withal register gains. After all, every fiscal asset exists with the idealistic purpose to grow and increment in price, right? Only if you're shorting a position during a balderdash run, it's most likely bad news for y'all.

Opposite to this, if the market place moves confronting the bulls, only those who open short trades would profit from the bear markets.

Back up and Resistance Levels

Back up and resistance levels are psychological on-chart areas, where the asset's toll used to show a turning point. If a support or resistance level gets broken, the price is very likely to exist setting up the base of a new trend.

A support level accumulates toll bottoms in the same area, while the resistance level refers to price tops. If the cost drops and breaks the support level, we might run into the start of a new bearish trend. Reverse to this, if the price increases and breaks a resistance level, this might exist the beginning of a new bullish trend.

Support and resistance levels work exceptionally well for determining entry and exit points on the chart.

Use Case: BTCUSD Technical Analysis

Beneath you will find a trade suggestion on the BTCUSD chart analyzing using different technical analysis.

The chart starts with an increasing volume. The price breaks its previous top during the increasing volume, and we get a buy signal. We assume the cost is entering a bullish trend, and we buy intending to collect profits from the eventual cost increase.

In this case, the proper identify for your cease-loss order is beneath the chart's previous bottom.

The price confirms the bullish trend and tests twice the established trend line every bit a support.

The breakout in the trend line during low trading book indicates that the trend is probably exhausted. That is a bespeak to close your merchandise.

This trade catches a bullish cost motility of more than than 10%.

Affiliate five

MUST-KNOW CRYPTO TRADING TERMS

Turn a profit aside, the fundamentals are still important. Imagine you misunderstood a limit order and a finish loss, seeing your positions got liquidated because of the empty-headed mistakes.

For sure information technology hurts!

If you don't want to pay the price for these mistakes e'er once again, here's exactly what y'all need.

Acquire the cardinal terms in crypto trading here.

1. Brokers vs. Trading Platform

A trading platform is used for trading digital avails. Meanwhile, the banker is the company that is in accuse of connecting your trades with the market place. Thus, yous trade on a crypto platform that is connected to a broker.

2. Spread

The spread is the difference between the buy and sells price of a cryptocurrency. That is where the broker collects the commissions for its service. Suppose an order book shows a selling BTC price of $56,000 and a buying price of $55,950, the spread between buyers and sellers is $50. The larger the liquidity and the volume, the lower the spread.

3. Leverage

Leverage is the amount of credit a trader borrows to open more significant trades. Leverage can vary from 0.5x to 125x, depending on the broker or the exchanges. Users who trade with leverage could make larger profits but also hateful they can exist more exposed to potential risks when speculation goes confronting it.

4. Margin in Cryptocurrency Trading

Margin in cryptocurrency trading allows users to use their funds as collateral to loan money from brokers or other traders. In this mode, investors can add leverage to their positions and register larger gains while trading in the market. Thus, margin and leverage are closely related in terms.

five. Order Book

The order book of a cryptocurrency exchange is the list of orders created by traders. These are trading orders that are waiting to exist filled. When investors open a sell limit order, then it would exist registered in the social club volume until it gets filled. The same happens if a trader would create a buying limit club.

6. Volume

The cryptocurrency market book is the number of coins or tokens that have been transacted during a specific time. Exchanges normally use 24-hours and one-hour measures to understand their volume levels. The volume can be measured in fiat value too.

For example, we tin say that in the last 24 hours, 100,000 BTC changed easily or that the BTCUSDT trading pair registered a trading volume of $x billion in the terminal 24 hours.

Above, you see an example of a basic book indicator and the signals we can take from it.

7. End-loss

The stop loss is a market lodge that will automatically shut your merchandise if the price reaches a sure level of loss that yous choose in advance. Stop-loss orders are very useful for professional traders to limit their chance. If the market moves in the wrong direction, then the stop-loss lodge would be executed, and the user would avoid registering larger losses.

8. Limit Gild

The limit gild takes you out of the market at a certain winning level, picked past the trader. This way, you can protect the profits from your trade against a returning move.

A well-planned merchandise will include a end-loss order and a limit order. This way, you'll have a clearer picture of what to aim for (with the limit social club) and how much you're ready to lose (with the stop-loss order).

9. Long and Curt A Position

A long position reflects a financial contract, where the profit comes from an expected toll increase. If you buy a cryptocurrency, and then y'all take a long position with it.

Contrary to this, in the brusk position, the turn a profit comes if the asset's toll decreases in value. If you short sell a cryptocurrency, so y'all have a short position there.

10. Maker and Taker Fees

Maker and taker fees are related to the fees users take to pay for providing liquidity or taking liquidity from the market place. When a trader opens a limit order, he is adding liquidity to the order book.

Instead, if the trader uses a market guild, he takes liquidity from the market order. Hence, the fees for opening a market order (taker fees) are higher than maker orders (maker fees).

CHAPTER 6

CRYPTO TRADING STRATEGIES

Crypto trading is exploding RIGHT NOW!

But, how much do you know? Practise you really have a strategy that tin can aid you turn a profit from the bulls?

Despite the fact that you lot've already understood the fundamentals, however, y'all must know how to execute and formulate a strategy for sustainable gains.

Dollar Cost Average (DCA)

The gilt rule when information technology comes to trading or investing is you never want to become all in. That's why you need to know dollar-cost averaging (DCA) to even out the losses. This trading strategy is elementary, and all you need to divide your capitals into smaller amounts later on open a position at the correct time according to your perfect entry toll.

Let's say Ash wants to invest $5,000 in BTC, just he uses DCA strategy to carve up his capital into 10 different lots with $500 each. Co-ordinate to his program, he'll exist buying $500 worth of BTC consecutively at a stock-still time or whenever his limit club is filled until he invested all $5,000.

Note:

By doing that, Ash is actually strategically protecting himself from the market volatility considering the BTC cost tin can soar and plunge more than 100% within minutes. In the cease, when Ash averages out his investments, he's near probable to get more BTC equally compared to invest them all at once at an overvalued price.

The Aureate Cross

A cross means when two chart indicator line crossover shows the average price of an asset over a menstruum of time for a convergence and departure betoken. This crypto trading strategy is commonly used when you lot're trading long-term as it deals with toll monitoring over a broader timeframe.

Typically, a gilt cross indicates the buy signals. Only to exercise that, first, you'll need to await into the Moving Averages (MA) indicator. When the 50MA crosses above 200MA, buyers dominate the power to bulldoze the current price even higher.

On the contrary, if the 50MA crosses below 200MA, it tells you that more traders are leaving the market, indicating a departure (sell signal).

On the downside, this strategy is for long-term trades, meaning it only works best if you're combining other indicators similar RSI to analyze the trend for more than than xviii months.

Relative Strength Alphabetize Divergence

Trust me; you would desire to know when trend reversals happen. The RSI divergence strategy works in a simpler way than you could imagine. The profits and losses are average out over two weeks to calculate the momentum in the range of 0 to 100.

That said, when the indicator line goes beyond 70, it ways an asset is overbought. But if it breaks below thirty, it'southward oversold. Information technology's recommended to apply a 4-hour time frame to expect for deviation and when the cost is in the oversold or overbought areas.

But, what does oversold or overbought really mean? And how tin can you lot gain from this information?

To put everything in context:

Of course, it'southward nifty to spot the tendency. Just, merely things are so simple.

In fact!

Using RSI deviation does non guarantee 100% accuracy on the trend signals as market manipulation, and breakouts tin happen anytime. Instead, you lot should use this crypto trading strategy to expect for discrepancies between the price and the RSI indicator every bit the price are almost moving in parallel.

Chapter seven

RISKS Direction

"Successful investing takes time, discipline and patience."

Warren Buffett

Even if you're confident enough to know how trading works, you're Not 100% shield from risks.

That's every decision you make involve risks!

To mitigate risks, here are what you must and must not exercise.

The Risks of Crypto Trading

Cryptocurrency trading, like any other trading activity, incur risks.

When we open a trade, nosotros need to know that there is a high possibility we volition non close it profitably. That means we might lose money on our trade. And since the cryptocurrency market is very volatile. Y'all should be enlightened that you lot can gain from the difference quickly within minutes just can as well exist liquidated if the market goes sideways and you did not set a cease-loss.

Dissimilar stocks, the crypto market is fluctuating more violently!

While kickoff-ups or newer released tokens have wider rooms for cost growth, it also ways information technology can be just another pump and dump situation where the market is manipulated for personal gains. This means the toll of the asset would move upwards very fast, and early buyers would sell at the top. This leaves tardily investors with large numberless of tokens that are now worthless.

Cryptocurrencies can be affected by forks or discontinuation. When a hard fork occurs, it's likely to take price volatility effectually the event. For example, Bitcoin Classic (BCH) is a difficult fork of Bitcoin. And BCH has split into 2 blockchains once more causes a significant plunge in its price.

Top Mistakes You Must Avoid

There are some things y'all should avoid while trading crypto:

Chapter 8

BONUS CHAPTER

According to the survey, ninety% of beginner traders would enquire how much should I start trading cryptocurrencies. And if it'south the right time to trade cryptocurrency at all.

Truth is!

When you stay on top of the marketplace, y'all're almost 50% there.

Here are some of the burning questions you may ask, and we answered!

Should Y'all Merchandise Cryptocurrency?

It is up to you to decide if y'all want to take a risk and start trading crypto. If yous are an enthusiast, who likes being involved in world innovations, then cryptocurrency trading might be a suitable job. But trading is not for anyone, as information technology requires technical and analytical thinking.

You should know the benefits and risks of each decision you brand when investing your funds in cryptocurrency trading. Moreover, you should be informed most marketplace conditions, do your research, perform technical and fundamental analysis and take the proper risk management decisions.

How Much To Start Crypto Trading?

You can start trading cryptocurrencies with modest amounts of money. Nevertheless, the larger the funds you invest, the larger the possible profits you can brand. All the same, this might be a risky activity.

Exchanges are allowing users to deposit pocket-sized amounts of digital assets. Thus you can somewhen first trading with just $x. Even so, this is not recommended, because that you might not be allowed to purchase more than funds if you lose part of your investment due to being lower than the $ten threshold.

Investing between $100 and $m would be much more logical.

Important Notation:

Withal, nosotros are non financial advisors, and this information should not be considered investment advice. This material is for educational purposes only. Y'all should never invest more what yous are ready to lose.

Users that would like to aggrandize and increment their trading position can use leverage. However, they should know the risks involved in trading with margin.

In The End

Cryptocurrency trading gains more than popularity amid fiscal enthusiasts nowadays. This is because it gives exposure to a new and expanding marketplace, which is considered the futurity of money.

Crypto trading might be overwhelming at the start. But equally soon every bit you kickoff trading with smaller amounts, you would be able to understand the processes, the tools, and how trading platforms work. If everything goes well, you lot tin always set college budgets and aim bigger.

You can always do it every bit long as it works. If information technology is non working and you are not profitable, you can always reconsider your trading approach and subtract your trading sizes once again. You will notice your best cryptocurrency approach. But one matter is 100% sure – it volition all showtime with an endeavour.

Source: https://learn.bybit.com/trading/what-is-cryptocurrency-trading/

Posted by: buidelps1967.blogspot.com

0 Response to "Forex For Beginners: What You Need To Know To Get Started...and Everything In Between!"

Post a Comment