iron condor strategy binary options

When yous began trading, you lot may have started out trading binary options because they are easy to sympathise, but every bit yous keep trading them, you may realize that they are difficult to practice.

If you compare binaries to spreads, it may seem that spreads are harder to understand at first, merely end up easier to trade.

Atomic number 26 Condor

An iron condor is a strategy that is traded on spreads. When using this strategy, you must sympathise what premium is. Premium is the deviation between where the spread is priced and where the market is currently at or quoting.

NASDAQ

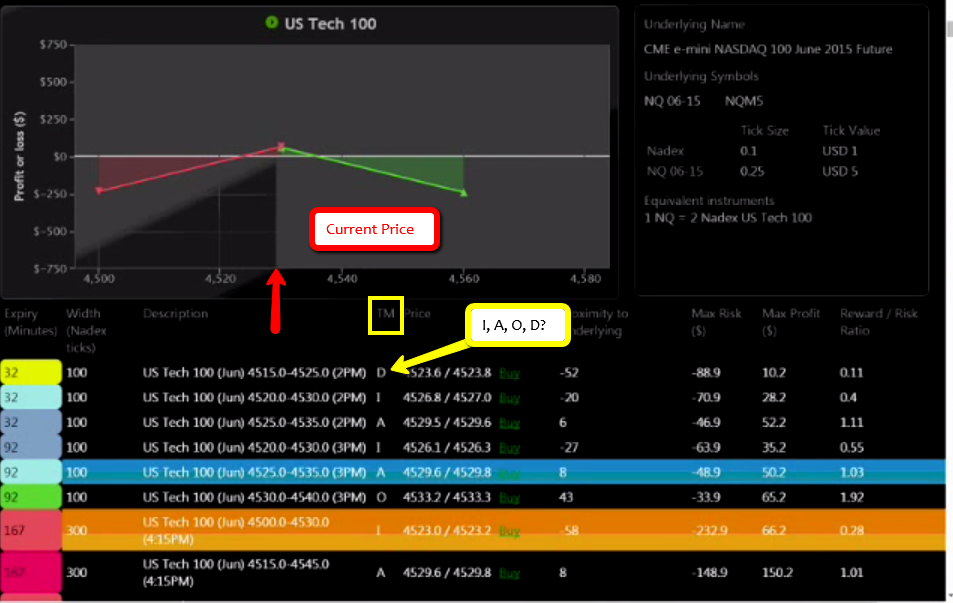

Every bit an instance, the following image shows the 4500-4530 NASDAQ spread with a iv:15PM ET expiration. The market is currently quoting at 4529.75. The risk is very controllable. This is not like a binary, meaning that yous are going to make or lose everything based on a tenth of a tick or a pip.

To view larger image, click Hither.

This is an In The Coin (ITM) spread. This spread example is trading in the money which means that information technology is trading between the flooring and the ceiling of the spread. The post-obit image shows that the gray expanse is the marketplace. It is currently at 4529 which is right between 4500 (floor) and 4530 (ceiling).

To view larger prototype, click Here.

The yellowish box in this image is around the messages T M which stands for The Marketplace. Each of the letters that appear in the cavalcade below those letters reference the particular strike price in relation to the marketplace. "A" means At The Market/Money and the proximity is low.

If it has an "I" or an "A", that ways the market is trading right in between the floor and the ceiling of the spread.

If it is In the Market/Coin, then whatever the proximity is that is shown on the scanner is the premium you tin collect when placing this trade.

"D" is for Deep in The Money/Market meaning if you are ownership the spread, the market is by the spread's ceiling or if yous are selling the spread, the market is already beneath the spread's floor. "O" is for Out of The Money/Market meaning the market is closer to the flooring of a long spread and closer to the ceiling of a short spread.

Buy The Lower

Wait at the orange highlighted spread. You can come across that the purchase price is 4523.2. If the market is quoting at 4529, that means you can buy the spread six points cheaper than where NASDAQ is currently trading. When you buy this lower spread, that gives yous half of your Iron Condor.

Sell The Upper

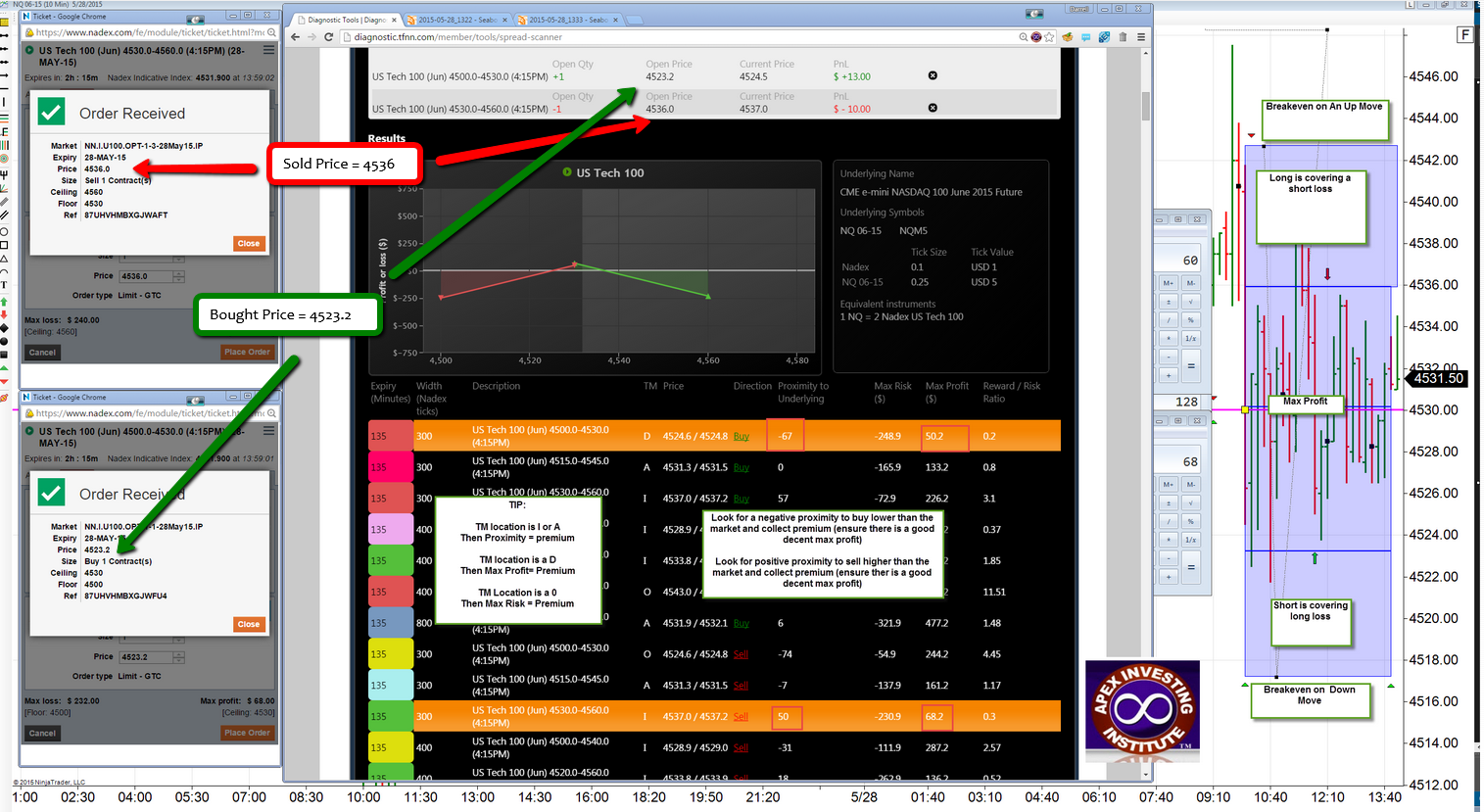

Iron condors are great for range bound trades. When y'all place both parts, the upper spread and the lower spread, it is like you are encircling an area in which the market will exist independent. Since the ceiling of the lower spread must be equal to the flooring of the upper spread, for this instance yous demand a spread that has 4530 as its lowest number. The 4530-4560 is the contract you choose to sell at 4536 which is viii points college than where the market place is currently trading.

Why Place This Trade?

In analyzing the logistics of this trade, you tin can say that the gamble is high and the profit is depression in comparison. You are taking reward of the premium and ownership lower than the market and selling college than the market. On the buy side, yous know that if the market goes up or stays flat, yous will brand max turn a profit. For this trade, yous bought at 4523.2, so you can make upward to the ceiling of 4530 for max profit.

4530-4523.2= six.viii which on Nadex is equal to $68. For every tick that information technology settles below the ceiling, y'all are giving upwardly $1 of profit. Recall, you too sold some other contract that you tin can utilise equally a hedge with the long contract.

You can suffer a loss of half dozen.8 points and still break even which will put it at 4536. Going up some other 6.8 points, to 4542.8 has you getting all of your money back and still being at pause even for both contracts.

What If The Market Pulls Back?

It was established that you could make $68 if the market flew up and hitting the ceiling on your long contract, but what if the market goes downwardly? You also sold a 4530-4560 contract.

To view larger image, click Here.

As shown in the prototype above, you can see that you sold at 4536. If it expires below 4530, you lot will still make $sixty. The market tin can go as far downwardly equally 4517 to hit breakeven. This is a massive range of 25 points on the NASDAQ where the market can move.

You volition make some amount of coin if it stays within that range. To figure out this range for whatsoever market, take the total premium and times past two. This gives you the number of how far it can move upwards and down.

You will remember for this example trade, in that location was a potential profit (premium) of $68 on the upper spread and $60 on the lower spread. Add those together for the total of $128. Therefore, the market place can motility 128 ticks up and/or 128 ticks downward. You brand $128 if the marketplace expires correct in the eye and you would lose $1 for each tick that it moves up or down from the center.

You can scout the radio testify where this trading strategy was explained in fifty-fifty more detail below. Elapsing: 38 Minutes.

To further your trading teaching, visit world wide web.apexinvesting.com.

The preceding commodity is from one of our external contributors. It does non represent the stance of Benzinga and has not been edited.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Source: https://www.benzinga.com/markets/binary-options/15/06/5577961/the-awesomeness-of-an-iron-condor

Posted by: buidelps1967.blogspot.com

0 Response to "iron condor strategy binary options"

Post a Comment